|

[X]

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

|

|

For

the fiscal year ended December 31, 2006

|

|

or

|

|

[ ]

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES

EXCHANGE ACT OF 1934

|

|

Commission

file number 1-1043

|

|

Delaware

|

36-0848180

|

|

(State

or other jurisdiction of incorporation

or

organization)

|

(I.R.S.

Employer Identification No.)

|

|

1

N. Field Court, Lake Forest, Illinois

|

60045-4811

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

(847)

735-4700

|

|

|

(Registrant’s

telephone number, including area

code)

|

|

|

Title

of each class

|

Name

of each exchange

on

which registered

|

|

Common

Stock ($0.75 par value)

|

New

York, Chicago and

|

|

Preferred

Stock Purchase Rights

|

London

Stock Exchanges

|

|

|

|

Page

|

|

PART

I

|

||

|

Item

1.

|

Business

|

1

|

|

Item

1A.

|

Risk

Factors

|

9

|

|

Item

1B.

|

Unresolved

Staff Comments

|

11

|

|

Item

2.

|

Properties

|

11

|

|

Item

3.

|

Legal

Proceedings

|

12

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

14

|

|

PART

II

|

||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder

Matters

and Issuer Purchases of Equity Securities

|

15

|

|

Item

6.

|

Selected

Financial Data

|

17

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition

and

Results of Operations

|

19

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

40

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

41

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting

and

Financial Disclosure

|

41

|

|

Item

9A.

|

Controls

and Procedures

|

41

|

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

42

|

|

Item

11.

|

Executive

Compensation

|

42

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and

Management

and Related Stockholder Matters

|

42

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

42

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

42

|

|

PART

IV

|

||

|

Item

15.

|

Exhibits

and Financial Statement Schedules

|

42

|

|

2006

|

2005

|

2004

|

||||||||

|

(in

millions)

|

||||||||||

|

Europe

|

$

|

925.1

|

$

|

926.4

|

$

|

849.4

|

||||

|

Pacific

Rim

|

303.2

|

315.6

|

277.9

|

|||||||

|

Canada

|

328.6

|

311.7

|

273.3

|

|||||||

|

Latin

America

|

158.3

|

133.7

|

101.2

|

|||||||

|

Africa

& Middle East

|

87.2

|

72.9

|

53.8

|

|||||||

|

$

|

1,802.4

|

$

|

1,760.3

|

$

|

1,555.6

|

|||||

| – |

A

marine engine product customization plant and distribution center

in

Belgium serving Europe, Africa and the Middle

East;

|

| – |

A

propeller and underwater sterngear manufacturing plant in the

United

Kingdom;

|

| – |

Sales

offices and distribution centers in Australia, Brazil, Canada,

China,

Japan, Malaysia, Mexico, New Zealand, Singapore and the United

Arab

Emirates;

|

| – | Sales offices in Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Sweden, Switzerland and the United Kingdom; |

| – |

Boat

manufacturing plants in Australia, China, Portugal and

Sweden;

|

| – |

An

outboard engine assembly plant in Suzhou, China;

and

|

| – |

A

marina and boat club in Suzhou, China, on Lake

Tai.

|

|

2006

|

2005

|

2004

|

||||||||

|

(in

millions)

|

||||||||||

|

Boat

|

$

|

38.0

|

$

|

36.1

|

$

|

28.3

|

||||

|

Marine

Engine

|

70.3

|

67.3

|

66.6

|

|||||||

|

Fitness

|

18.4

|

14.2

|

16.0

|

|||||||

|

Bowling

& Billiards

|

5.5

|

5.9

|

5.9

|

|||||||

|

Total

|

$

|

132.2

|

$

|

123.5

|

$

|

116.8

|

||||

|

Boat

|

13,850

|

|||

|

Marine

Engine

|

6,400

|

|||

|

Fitness

|

2,050

|

|||

|

Bowling

& Billiards

|

5,400

|

|||

|

Corporate

|

300

|

|||

|

Total

|

28,000

|

|||

|

Officer

|

Present

Position

|

Age

|

||

|

Dustan

E. McCoy

|

Chairman

and Chief Executive Officer

|

57

|

||

|

Peter

B. Hamilton (A)

|

Vice

Chairman and President - Brunswick Boat Group

|

60

|

||

|

Patrick

C. Mackey

|

Executive

Vice President, Chief Operating Officer - Marine

and

President - Mercury Marine Group

|

60

|

||

|

Peter

G. Leemputte

|

Senior

Vice President and Chief Financial Officer

|

49

|

||

|

Tzau

J. Chung

|

Vice

President and President - Brunswick New Technologies

|

43

|

||

|

Warren

N. Hardie

|

Vice

President and President - Brunswick Bowling &

Billiards

|

56

|

||

|

B.

Russell Lockridge

|

Vice

President and Chief Human Resources Officer

|

57

|

||

|

Alan

L. Lowe

|

Vice

President and Controller

|

55

|

||

|

Marschall

I. Smith

|

Vice

President, General Counsel and Secretary

|

62

|

||

|

John

E. Stransky

|

Vice

President and President - Life Fitness Division

|

55

|

|

Issuer

Purchases of Equity Securities

|

|||||||||||||

|

Period

|

Total

Number

of

Shares

(or

Units)

Purchased

|

Average

Price

Paid

per

Share

(or

Unit)

|

Total

Number of

Shares

(or Units)

Purchased

as Part of

Publicly

Announced

Plans

or Programs

|

Maximum

Number (or

Approximate

Dollar

Value)

of Shares (or

Units)

that May Yet Be

Purchased

Under the

Plans

or Programs

(in

thousands)

|

|||||||||

|

10/01/06

- 10/28/06

|

—

|

|

$

—

|

—

|

|

$

398,674

|

|||||||

|

10/29/06

- 11/25/06

|

150,000

|

|

$

32.52

|

150,000

|

|

$

393,796

|

|||||||

|

11/26/06

- 12/31/06

|

850,000

|

|

$

32.43

|

850,000

|

|

$

366,232

|

|||||||

|

Total

Share Repurchases

|

1,000,000

|

|

$

32.44

|

1,000,000

|

|

$

366,232

|

|||||||

|

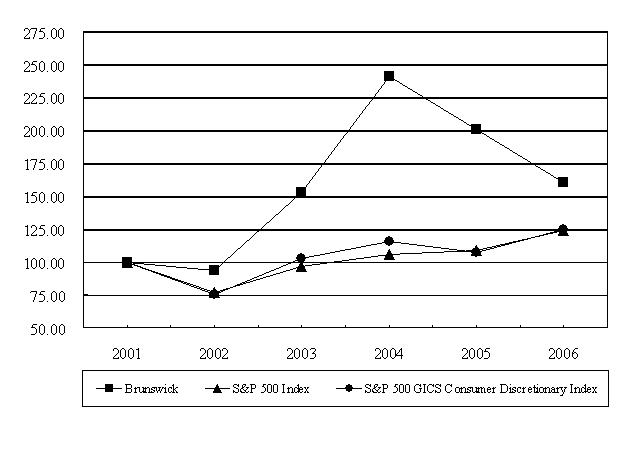

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

||||||

|

Brunswick

|

100.00

|

93.46

|

152.69

|

240.96

|

200.56

|

159.95

|

|||||

|

S&P

500 Index

|

100.00

|

76.63

|

96.85

|

105.56

|

108.73

|

123.54

|

|||||

|

S&P

500 GICS Consumer Discretionary

Index

|

100.00

|

75.56

|

102.82

|

115.31

|

106.83

|

125.24

|

|

(in

millions, except per share data)

|

2006

|

2005

|

2004

|

2003

|

2002

|

2001

|

|||||||||||||

|

Results

of operations data

|

|||||||||||||||||||

|

Net

sales

|

$

|

5,665.0

|

$

|

5,606.9

|

$

|

5,058.1

|

$

|

4,063.6

|

$

|

3,711.9

|

$

|

3,370.8

|

|||||||

|

Operating

earnings

|

$

|

341.2

|

$

|

468.7

|

$

|

394.8

|

$

|

223.5

|

$

|

197.4

|

$

|

191.1

|

|||||||

|

Earnings

before interest and taxes

|

$

|

354.2

|

$

|

524.1

|

$

|

408.4

|

$

|

233.6

|

$

|

200.7

|

$

|

179.5

|

|||||||

|

Earnings

before income taxes

|

$

|

309.7

|

$

|

485.9

|

$

|

373.3

|

$

|

204.0

|

$

|

162.4

|

$

|

132.2

|

|||||||

|

Earnings

from continuing operations

|

$

|

263.2

|

$

|

371.1

|

$

|

263.8

|

$

|

137.0

|

$

|

104.1

|

$

|

84.7

|

|||||||

|

Discontinued

operations:

|

|||||||||||||||||||

|

Earnings

(loss) from discontinued

operations,

net of tax (A)

|

(129.3

|

)

|

14.3

|

6.0

|

(1.8

|

)

|

(0.6

|

)

|

—

|

||||||||||

|

Cumulative

effect of changes in accounting

principle,

net of tax (B)

|

—

|

—

|

—

|

—

|

(25.1

|

)

|

(2.9

|

)

|

|||||||||||

|

Net

earnings

|

$

|

133.9

|

$

|

385.4

|

$

|

269.8

|

$

|

135.2

|

$

|

78.4

|

$

|

81.8

|

|||||||

|

Basic

earnings (loss) per common share:

|

|||||||||||||||||||

|

Earnings

from continuing operations before

accounting

change

|

$

|

2.80

|

$

|

3.80

|

$

|

2.76

|

$

|

1.50

|

$

|

1.16

|

$

|

0.96

|

|||||||

|

Discontinued

operations:

|

|||||||||||||||||||

|

Earnings

(loss) from discontinued

operations,

net of tax

|

(1.38

|

)

|

0.15

|

0.06

|

(0.02

|

)

|

(0.01

|

)

|

—

|

||||||||||

|

Cumulative

effect of changes in accounting

principle,

net of tax (B)

|

—

|

—

|

—

|

—

|

(0.28

|

)

|

(0.03

|

)

|

|||||||||||

|

Net

earnings

|

$

|

1.42

|

$

|

3.95

|

$

|

2.82

|

$

|

1.48

|

$

|

0.87

|

$

|

0.93

|

|||||||

|

Average

shares used for computation of

basic

earnings per share

|

94.0

|

97.6

|

95.6

|

91.2

|

90.0

|

87.8

|

|||||||||||||

|

Diluted

earnings (loss) per common share:

|

|||||||||||||||||||

|

Earnings

from continuing operations before

accounting

change

|

$

|

2.78

|

$

|

3.76

|

$

|

2.71

|

$

|

1.49

|

$

|

1.15

|

$

|

0.96

|

|||||||

|

Discontinued

operations:

|

|||||||||||||||||||

|

Earnings

(loss) from discontinued

operations,

net of tax

|

(1.37

|

)

|

0.14

|

0.06

|

(0.02

|

)

|

(0.01

|

)

|

—

|

||||||||||

|

Cumulative

effect of changes in accounting

principle,

net of tax (B)

|

—

|

—

|

—

|

—

|

(0.28

|

)

|

(0.03

|

)

|

|||||||||||

|

Net

earnings

|

$

|

1.41

|

$

|

3.90

|

$

|

2.77

|

$

|

1.47

|

$

|

0.86

|

$

|

0.93

|

|||||||

|

Average

shares used for computation of

diluted

earnings per share

|

94.7

|

98.8

|

97.3

|

91.9

|

90.7

|

88.1

|

|||||||||||||

|

(in

millions, except per share and other data)

|

2006

|

2005

|

2004

|

2003

|

2002

|

2001

|

|||||||||||||

|

Balance

sheet data

|

|||||||||||||||||||

|

Assets

of continuing operations

|

$

|

4,312.0

|

$

|

4,414.8

|

$

|

4,198.9

|

$

|

3,523.4

|

$

|

3,306.4

|

$

|

3,157.5

|

|||||||

|

Debt

Short-term

|

$

|

0.7

|

$

|

1.1

|

$

|

10.7

|

$

|

23.8

|

$

|

28.9

|

$

|

40.0

|

|||||||

|

Long-term

|

725.7

|

723.7

|

728.4

|

583.8

|

589.5

|

600.2

|

|||||||||||||

|

Total

debt

|

726.4

|

724.8

|

739.1

|

607.6

|

618.4

|

640.2

|

|||||||||||||

|

Common

shareholders’ equity (C)

|

1,871.8

|

1,978.8

|

1,712.3

|

1,323.0

|

1,101.8

|

1,110.9

|

|||||||||||||

|

Total

capitalization (C)

|

$

|

2,598.2

|

$

|

2,703.6

|

$

|

2,451.4

|

$

|

1,930.6

|

$

|

1,720.2

|

$

|

1,751.1

|

|||||||

|

Cash

flow data

Net

cash provided by operating activities of

continuing

operations

|

$

|

351.0

|

$

|

421.6

|

$

|

424.4

|

$

|

405.7

|

$

|

413.4

|

$

|

299.3

|

|||||||

|

Depreciation

and amortization

|

167.3

|

156.3

|

153.6

|

149.4

|

148.4

|

160.4

|

|||||||||||||

|

Capital

expenditures

|

205.1

|

223.8

|

163.8

|

157.7

|

112.6

|

111.4

|

|||||||||||||

|

Acquisitions

of businesses

|

86.2

|

130.3

|

248.2

|

140.0

|

16.4

|

134.4

|

|||||||||||||

|

Investments

|

(6.1

|

)

|

18.1

|

16.2

|

39.3

|

8.9

|

—

|

||||||||||||

|

Stock

repurchases

|

195.6

|

76.0

|

—

|

—

|

—

|

—

|

|||||||||||||

|

Cash

dividends paid

|

55.0

|

57.3

|

58.1

|

45.9

|

45.1

|

43.8

|

|||||||||||||

|

Other

data

Dividends

declared per share

|

$

|

0.60

|

$

|

0.60

|

$

|

0.60

|

$

|

0.50

|

$

|

0.50

|

$

|

0.50

|

|||||||

|

Book

value per share (C)

|

19.76

|

20.03

|

17.60

|

14.40

|

12.15

|

12.61

|

|||||||||||||

|

Return

on beginning shareholders’ equity

|

6.8

|

%

|

22.5

|

%

|

20.4

|

%

|

12.3

|

%

|

7.0

|

%

|

7.7

|

%

|

|||||||

|

Effective

tax rate (D)

|

21.6

|

%

|

22.3

|

%

|

28.7

|

%

|

32.8

|

%

|

36.0

|

%

|

36.0

|

%

|

|||||||

|

Debt-to-capitalization

rate (C)

|

28.0

|

%

|

26.8

|

%

|

30.2

|

%

|

31.5

|

%

|

35.9

|

%

|

36.6

|

%

|

|||||||

|

Number

of employees

|

28,000

|

26,500

|

24,745

|

22,525

|

20,815

|

20,700

|

|||||||||||||

|

Number

of shareholders of record

|

13,695

|

14,143

|

14,952

|

15,373

|

16,605

|

13,200

|

|||||||||||||

|

Common

stock price (NYSE)

High

|

$

|

42.30

|

$

|

49.50

|

$

|

49.85

|

$

|

32.08

|

$

|

30.01

|

$

|

25.01

|

|||||||

|

Low

|

27.56

|

35.09

|

31.25

|

16.35

|

18.30

|

14.03

|

|||||||||||||

|

Close

(last trading day)

|

31.90

|

40.66

|

49.50

|

31.83

|

19.86

|

21.76

|

|||||||||||||

|

•

|

Introducing

high-quality and reliable products with innovative and new technologies

in

all of Brunswick’s market segments;

|

|

•

|

Distributing

products through a model that benefits the Company’s dealers and

distributors by providing additional products and services that will

make

them more successful, improve the customer experience and, in turn,

make

Brunswick more successful;

|

|

•

|

Focusing

on cost reduction initiatives through global sourcing and realignment

of

Brunswick’s manufacturing operations and organizational

structure;

|

|

•

|

Continuing

to expand and enhance Brunswick’s global manufacturing footprint to

achieve best-cost positions; and

|

|

•

|

Acquiring

and investing in businesses that will expand and enhance Brunswick’s

product offerings, particularly in boats and parts &

accessories.

|

| – |

The

continued rollout of Mercury Marine’s Verado, a family of supercharged

four-stroke outboard engines, into smaller naturally aspirated

four-cylinder models ranging from 135 to 175 horsepower, complementing

the

larger six-cylinder supercharged models, ranging from 200 to 300

horsepower;

|

| – |

The

debut of single-cylinder 2.5 and 3.5 horsepower four-stroke outboard

engines, allowing Mercury Marine to offer a full line of four-stroke

engines from 2.5 horsepower through the 300 horsepower

Verado;

|

| – |

Introduction

of two new direct-injected OptiMax two-stroke outboard engines with

250

and 300 horsepower;

|

| – |

New

boat models across all boat divisions, many of which utilize Brunswick’s

High Performance Product Development (HPPD) process to integrate

the

design, engineering and manufacturing processes from start to

finish;

|

| – |

New

cardiovascular and strength training fitness product offerings, including

the T5 and T7 treadmill series and the Summit Trainer, designed to

simplify and enhance the workout experience;

|

| – |

Opening

of a state-of-the-art research and development lab in Life Fitness’

Franklin Park, Illinois, facility, which is being used to drive innovation

and future product improvements;

|

| – |

Launch

of Vivo, Life Fitness’ new wireless connectivity technology that

integrates health clubs, fitness equipment, and exercisers to provide

a

more personalized workout experience by allowing users to record

workout

data and track progress toward their goals, and allowing health clubs

to

obtain enhanced data on usage and programs to better market them

to their

customers; and

|

| – |

Continued

expansion of the larger Brunswick Zone XL family bowling entertainment

centers.

|

| – |

Consolidation

of certain boat manufacturing facilities, sales offices and distribution

centers to streamline operations, including the transfer of Lund

Canada

production from Steinbach, Manitoba, Canada, to Lund’s New York Mills,

Minnesota, facility, and the transfer of a portion of US Marine’s Bayliner

production from one of its two Cumberland, Maryland, plants to its

operations in Pipestone, Minnesota;

|

| – |

Streamlined

organizational structure across the Boat Group to advance the integration

of Brunswick’s marine operations and enhance the ability to achieve new

efficiencies and networking

competencies;

|

| – |

Commenced

bowling ball manufacturing operations in Reynosa, Mexico, to which

the

transition from Muskegon, Michigan, will be completed in 2007;

and

|

| – |

Announcement

of the relocation of Brunswick’s Valley-Dynamo manufacturing operations

from Richland Hills, Texas, to Reynosa, Mexico, where production

is

expected to commence in early- to mid-2007.

|

| – |

Purchase

of Cabo Yachts, which complements the sportfishing convertibles offered

by

Brunswick’s Albemarle and Hatteras brands, the three of which now comprise

the Hatteras Collection;

|

| – |

Acquisition

of Diversified Marine, which adds significant capacity to Brunswick’s

parts and accessories business and provides an essential distribution

hub

in the western United States; and

|

| – |

Acquisition

of Blue Water Dealer Services, allowing Brunswick to offer a more

complete

line of financial services to its boat and marine engine dealers

and their

customers.

|

| – |

Increased

investments in operations in Europe, the Pacific Rim and Latin America

supporting international sales, which now represent approximately

32

percent of net sales from continuing operations;

and

|

| – |

Purchase

of an additional 13.3 percent of the outstanding stock of Protokon,

a

Hungarian fitness equipment manufacturer, which allows Brunswick

to better

service fitness customers in

Europe.

|

| – |

Continued

purchases under a $500 million share repurchase program, buying back

approximately 5.6 million shares of Brunswick common stock for

approximately $196 million during 2006;

and

|

| – |

Maintaining

an annual dividend payment of $0.60 per share.

|

|

Date

|

Description

|

Segment

|

||

|

2/28/05

|

Albemarle

Boats, Inc. (Albemarle)

|

Boat

|

||

|

5/27/05

|

Triton

Boat Company, L.P. (Triton)

|

Boat

|

||

|

6/20/05

|

Supra-Industria

Textil, Lda. (Valiant) - 51 percent

|

Marine

Engine

|

||

|

7/07/05

|

Kellogg

Marine, Inc. (Kellogg)

|

Boat

|

||

|

9/16/05

|

Harris

Kayot Marine, LLC (Harris Kayot)

|

Boat

|

||

|

2/16/06

|

Cabo

Yachts, Inc. (Cabo)

|

Boat

|

||

|

4/26/06

|

Diversified

Marine Products, L.P. (Diversified)

|

Boat

|

|

Date

|

Description

|

Segment

|

||

|

4/01/04

|

Lowe,

Lund, Crestliner

|

Boat

|

||

|

12/31/04

|

Sea

Pro, Sea Boss and Palmetto boats (Sea Pro)

|

Boat

|

||

|

2/28/05

|

Albemarle

Boats, Inc.

|

Boat

|

||

|

5/27/05

|

Triton

Boat Company, L.P.

|

Boat

|

||

|

6/20/05

|

Supra-Industria

Textil, Lda. - 51 percent

|

Marine

Engine

|

||

|

7/07/05

|

Kellogg

Marine, Inc.

|

Boat

|

||

|

9/16/05

|

Harris

Kayot Marine, LLC

|

Boat

|

|

|

2006

|

2005

|

2004

|

|||||||

|

Net

earnings from continuing operations per

diluted

share — as reported

|

$

|

2.78

|

$

|

3.76

|

$

|

2.71

|

||||

|

Tax

items

|

(0.50

|

)

|

(0.31

|

)

|

(0.10

|

)

|

||||

|

Investment

sale gain

|

—

|

(0.32

|

)

|

—

|

||||||

|

Net

earnings from continuing operations per

diluted

share — as adjusted

|

$

|

2.28

|

$

|

3.13

|

$

|

2.61

|

||||

|

•

|

Tax

Items:

During 2006, the Company reduced its tax provision primarily due

to $47.0

million of tax benefits ($0.50 per diluted share), consisting of

$42.6

million of tax reserve reassessments of underlying exposures and

the

recognition of a $4.4 million interest receivable related to the

completion of IRS audits of prior taxable years. Refer to Note

10 - Commitments and Contingencies

in

the Notes to Consolidated Financial Statements for further detail.

|

|

In

2004, the Internal Revenue Service completed its routine audit of

tax

years 1998 through 2001. Following the completion of the examination

of

this four-year period, the Company reduced its tax reserves and,

consequently, its tax provision by $10.0 million ($0.10 per diluted

share).

|

|

•

|

Investment

Sale Gain:

On

February 23, 2005, the Company sold its investment of 1,861,200 shares

in

MarineMax, Inc. (MarineMax), its largest boat dealer, for $56.8 million,

net of $4.1 million of selling costs, which included $1.1 million

of

accrued expenses. The sale was made pursuant to a registered public

offering by MarineMax. As a result of this sale, the Company recorded

an

after-tax gain of $31.5 million ($0.32 per diluted share) after utilizing

previously unrecognized capital loss carryforwards.

|

|

2006

vs. 2005

Increase/(Decrease)

|

2005

vs. 2004

Increase/(Decrease)

|

|||||||||||||||||||||

|

2006

|

2005

|

2004

|

$

|

%

|

$

|

%

|

||||||||||||||||

|

(in

millions, except per share data)

|

||||||||||||||||||||||

|

Net

sales

|

$

|

5,665.0

|

$

|

5,606.9

|

$

|

5,058.1

|

$

|

58.1

|

1.0

|

%

|

$

|

548.8

|

10.9

|

%

|

||||||||

|

Gross

margin (A)

(C)

|

$

|

1,225.7

|

$

|

1,321.6

|

$

|

1,248.5

|

$

|

(95.9

|

)

|

(7.3

|

)%

|

$

|

73.1

|

5.9

|

%

|

|||||||

|

Operating

earnings (C)

|

$

|

341.2

|

$

|

468.7

|

$

|

394.8

|

$

|

(127.5

|

)

|

(27.2

|

)%

|

$

|

73.9

|

18.7

|

%

|

|||||||

|

Net

earnings

|

$

|

263.2

|

$

|

371.1

|

$

|

263.8

|

$

|

(107.9

|

)

|

(29.1

|

)%

|

$

|

107.3

|

40.7

|

%

|

|||||||

|

Diluted

earnings per share

|

$

|

2.78

|

$

|

3.76

|

$

|

2.71

|

$

|

(0.98

|

)

|

(26.1

|

)%

|

$

|

1.05

|

38.7

|

%

|

|||||||

|

Expressed

as a percentage of Net sales (B)

|

||||||||||||||||||||||

|

Gross

margin (C)

|

21.6

|

%

|

23.6

|

%

|

24.7

|

%

|

(200

|

)bpts |

(110

|

)bpts | ||||||||||||

|

Selling,

general and administrative expense

(C)

|

13.3

|

%

|

13.0

|

%

|

14.6

|

%

|

30

|

bpts |

(160

|

)bpts | ||||||||||||

|

Research

& development expense

|

2.3

|

%

|

2.2

|

%

|

2.3

|

%

|

10

|

bpts |

(10

|

)bpts | ||||||||||||

|

Operating

margin (C)

|

6.0

|

%

|

8.4

|

%

|

7.8

|

%

|

(240

|

)bpts |

60

|

bpts | ||||||||||||

|

2006

vs. 2005

Increase(Decrease)

|

2005

vs. 2004

Increase/(Decrease)

|

|||||||||||||||||||||

|

2006

|

2005

|

2004

|

$

|

%

|

$

|

%

|

||||||||||||||||

|

(in

millions)

|

||||||||||||||||||||||

|

Net

sales

|

$

|

2,864.4

|

$

|

2,783.4

|

$

|

2,285.0

|

$

|

81.0

|

2.9

|

%

|

$

|

498.4

|

21.8

|

%

|

||||||||

|

Operating

earnings (A)

|

$

|

135.6

|

$

|

192.5

|

$

|

150.4

|

$

|

(56.9

|

)

|

(29.6

|

)%

|

$

|

42.1

|

28.0

|

%

|

|||||||

|

Operating

margin (A)

|

4.7

|

%

|

6.9

|

%

|

6.6

|

%

|

(220

|

)bpts |

30

|

bpts | ||||||||||||

|

Capital

expenditures

|

$

|

75.8

|

$

|

74.7

|

$

|

56.5

|

$

|

1.1

|

1.5

|

%

|

$

|

18.2

|

32.2

|

%

|

||||||||

|

2006

vs. 2005 Increase/(Decrease) |

2005

vs. 2004

Increase/(Decrease)

|

|||||||||||||||||||||

|

2006

|

2005

|

2004

|

$

|

%

|

$

|

%

|

||||||||||||||||

|

(in

millions)

|

||||||||||||||||||||||

|

Net

sales

|

$

|

2,271.3

|

$

|

2,300.6

|

$

|

2,165.8

|

$

|

(29.3

|

)

|

(1.3

|

)%

|

$

|

134.8

|

6.2

|

%

|

|||||||

|

Operating

earnings (A)

|

$

|

193.8

|

$

|

250.5

|

$

|

237.2

|

$

|

(56.7

|

)

|

(22.6

|

)%

|

$

|

13.3

|

5.6

|

%

|

|||||||

|

Operating

margin (A)

|

8.5

|

%

|

10.9

|

%

|

11.0

|

%

|

(240

|

)bpts |

(10)

|

bpts | ||||||||||||

|

Capital

expenditures

|

$

|

72.5

|

$

|

91.5

|

$

|

68.7

|

$

|

(19.0

|

)

|

(20.8

|

)%

|

$

|

22.8

|

33.2

|

%

|

|||||||

|

2006

vs. 2005

Increase/(Decrease)

|

2005

vs. 2004

Increase/(Decrease)

|

|||||||||||||||||||||

|

2006

|

2005

|

2004

|

$

|

%

|

$

|

%

|

||||||||||||||||

|

(in

millions)

|

||||||||||||||||||||||

|

Net

sales

|

$

|

593.1

|

$

|

551.4

|

$

|

558.8

|

$

|

41.7

|

7.6

|

%

|

$

|

(7.4

|

)

|

(1.3

|

)%

|

|||||||

|

Operating

earnings

|

$

|

57.8

|

$

|

56.1

|

$

|

44.2

|

$

|

1.7

|

3.0

|

%

|

$

|

11.9

|

26.9

|

%

|

||||||||

|

Operating

margin

|

9.7

|

%

|

10.2

|

%

|

7.9

|

%

|

(50

|

)bpts |

230

|

bpts | ||||||||||||

|

Capital

expenditures

|

$

|

11.0

|

$

|

11.2

|

$

|

8.3

|

$

|

(0.2

|

)

|

(1.8

|

)%

|

$

|

2.9

|

34.9

|

%

|

|||||||

|

2006

vs. 2005

Increase/(Decrease)

|

2005

vs. 2004

Increase/(Decrease)

|

|||||||||||||||||||||

|

2006

|

2005

|

2004

|

$

|

%

|

$

|

%

|

||||||||||||||||

|

(in

millions)

|

||||||||||||||||||||||

|

Net

sales

|

$

|

458.3

|

$

|

464.5

|

$

|

442.4

|

$

|

(6.2

|

)

|

(1.3

|

)%

|

$

|

22.1

|

5.0

|

%

|

|||||||

|

Operating

earnings (A)

|

$

|

22.1

|

$

|

37.2

|

$

|

41.7

|

$

|

(15.1

|

)

|

(40.6

|

)%

|

$

|

(4.5

|

)

|

(10.8

|

)%

|

||||||

|

Operating

margin (A)

|

4.8

|

%

|

8.0

|

%

|

9.4

|

%

|

(320

|

)bpts |

(140)

|

bpts | ||||||||||||

|

Capital

expenditures

|

$

|

43.7

|

$

|

36.8

|

$

|

27.7

|

$

|

6.9

|

18.8

|

%

|

$

|

9.1

|

32.9

|

%

|

||||||||

|

2006

|

2005

|

2004

|

||||||||

|

(in

millions)

|

||||||||||

|

Net

cash provided by operating activities of continuing

operations

|

$

|

351.0

|

$

|

421.6

|

$

|

424.4

|

||||

|

Net

cash provided by (used for):

|

||||||||||

|

Capital

expenditures

|

(205.1

|

)

|

(223.8

|

)

|

(163.8

|

)

|

||||

|

Proceeds

from investment sale

|

—

|

57.9

|

—

|

|||||||

|

Proceeds

from the sale of property, plant and equipment

|

7.2

|

13.4

|

13.4

|

|||||||

|

Other,

net

|

(0.4

|

)

|

(1.2

|

)

|

2.0

|

|||||

|

Free

cash flow from continuing operations *

|

$

|

152.7

|

$

|

267.9

|

$

|

276.0

|

||||

|

Payments

due by period

|

||||||||||||||||

|

(in

millions)

|

Total

|

Less

than

1

year

|

1-3

years

|

3-5

years

|

More

than

5

years

|

|||||||||||

|

Contractual

Obligations

|

||||||||||||||||

|

Short-term

debt (1)

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

||||||

|

Long-term

debt (1)

|

726.4

|

0.7

|

251.6

|

149.8

|

324.3

|

|||||||||||

|

Interest

payments on long-term debt

|

520.2

|

46.0

|

84.1

|

57.5

|

332.6

|

|||||||||||

|

Operating

leases (2)

|

186.6

|

42.9

|

61.5

|

39.7

|

42.5

|

|||||||||||

|

Purchase

obligations (3)

|

234.1

|

228.5

|

2.7

|

2.6

|

0.3

|

|||||||||||

|

Deferred

pension liability (4)

|

55.6

|

3.0

|

5.9

|

5.9

|

40.8

|

|||||||||||

|

Deferred

management compensation (5)

|

84.5

|

4.2

|

11.8

|

15.3

|

53.2

|

|||||||||||

|

Other

long-term liabilities (6)

|

158.7

|

64.6

|

71.9

|

14.8

|

7.4

|

|||||||||||

|

Total

contractual obligations

|

$

|

1,966.1

|

$

|

389.9

|

$

|

489.5

|

$

|

285.6

|

$

|

801.1

|

||||||

|

(in

millions)

|

2006

|

2005

|

|||||

|

Risk

Category

|

|||||||

|

Foreign

exchange

|

$

|

34.3

|

$

|

35.9

|

|||

|

Interest

rates

|

$

|

1.0

|

$

|

6.2

|

|||

|

Commodity

prices

|

$

|

2.2

|

$

|

1.2

|

|||

|

|

Page

|

|

Financial

Statements:

|

|

|

Report

of Management on Internal Control over Financial Reporting

|

44

|

|

Report

of Independent Registered Public Accounting Firm on Internal Control

over

Financial Reporting

|

45

|

|

Report

of Independent Registered Public Accounting Firm

|

46

|

|

Consolidated

Statements of Income for the Years Ended December 31, 2006, 2005

and

2004

|

47

|

|

Consolidated

Balance Sheets as of December 31, 2006 and 2005

|

48

|

|

Consolidated

Statements of Cash Flows for the Years Ended December 31, 2006, 2005

and

2004

|

50

|

|

Consolidated

Statements of Shareholders’ Equity for the Years Ended December 31, 2006,

2005 and 2004

|

51

|

|

Notes

to Consolidated Financial Statements

|

52

|

|

Financial

Statement Schedule:

|

|

|

Schedule

II - Valuation and Qualifying Accounts

|

86

|

| /s/ DUSTAN E. McCOY | /s/ PETER G. LEEMPUTTE |

|

Dustan

E. McCoy

Chairman

and Chief Executive Officer

|

Peter

G. Leemputte

Senior

Vice President and Chief Financial

Officer

|

|

BRUNSWICK

CORPORATION

|

|

Consolidated

Statements of Income

|

|

For

the Years Ended December 31

|

||||||||||

|

2006

|

2005

|

2004

|

||||||||

|

(in

millions, except per share data)

|

||||||||||

|

Net

sales

|

$

|

5,665.0

|

$

|

5,606.9

|

$

|

5,058.1

|

||||

|

Cost

of sales

|

4,439.3

|

4,285.3

|

3,809.6

|

|||||||

|

Selling,

general and administrative expense

|

752.3

|

729.4

|

736.9

|

|||||||

|

Research

and development expense

|

132.2

|

123.5

|

116.8

|

|||||||

|

Operating

earnings

|

341.2

|

468.7

|

394.8

|

|||||||

|

Equity

earnings

|

14.9

|

18.1

|

18.1

|

|||||||

|

Investment

sale gain

|

-

|

38.7

|

-

|

|||||||

|

Other

expense, net

|

(1.9

|

)

|

(1.4

|

)

|

(4.5

|

)

|

||||

|

Earnings

before interest and income taxes

|

354.2

|

524.1

|

408.4

|

|||||||

|

Interest

expense

|

(60.5

|

)

|

(53.2

|

)

|

(45.2

|

)

|

||||

|

Interest

income

|

16.0

|

15.0

|

10.1

|

|||||||

|

Earnings

before income taxes

|

309.7

|

485.9

|

373.3

|

|||||||

|

Income

tax provision

|

46.5

|

114.8

|

109.5

|

|||||||

|

Net

earnings from continuing operations

|

263.2

|

371.1

|

263.8

|

|||||||

|

Discontinued

operations:

|

||||||||||

|

Earnings

(loss) from discontinued operations, net of tax

|

(43.7

|

)

|

14.3

|

6.0

|

||||||

|

Impairment

charges on assets held for sale, net of tax

|

(85.6

|

)

|

-

|

-

|

||||||

|

Net

earnings (loss) from discontinued

operations,

net of tax

|

(129.3

|

)

|

14.3

|

6.0

|

||||||

|

Net

earnings

|

$

|

133.9

|

$

|

385.4

|

$

|

269.8

|

||||

|

Earnings

per common share:

|

||||||||||

|

Basic

|

||||||||||

|

Earnings

from continuing operations

|

$

|

2.80

|

$

|

3.80

|

$

|

2.76

|

||||

|

Earnings

(loss) from discontinued operations

|

(1.38

|

)

|

0.15

|

0.06

|

||||||

|

Net

earnings

|

$

|

1.42

|

$

|

3.95

|

$

|

2.82

|

||||

|

Diluted

|

||||||||||

|

Earnings

from continuing operations

|

$

|

2.78

|

$

|

3.76

|

$

|

2.71

|

||||

|

Earnings

(loss) from discontinued operations

|

(1.37

|

)

|

0.14

|

0.06

|

||||||

|

Net

earnings

|

$

|

1.41

|

$

|

3.90

|

$

|

2.77

|

||||

|

Weighted

average shares used for computation of:

|

||||||||||

|

Basic

earnings per share

|

94.0

|

97.6

|

95.6

|

|||||||

|

Diluted

earnings per share

|

94.7

|

98.8

|

97.3

|

|||||||

|

Cash

dividends declared per common share

|

$

|

0.60

|

$

|

0.60

|

$

|

0.60

|

||||

|

The

Notes to Consolidated Financial Statements are an integral part of

these

consolidated statements.

|

||||||||||

|

BRUNSWICK

CORPORATION

|

|

Consolidated

Balance Sheets

|

|

As

of December 31

|

|||||||

|

2006

|

2005

|

||||||

|

(in

millions)

|

|||||||

|

Assets

|

|||||||

|

Current

assets

|

|||||||

|

Cash

and cash equivalents, at cost, which approximates market

|

$

|

283.4

|

$

|

487.7

|

|||

|

Accounts

and notes receivable, less allowances of $29.7 and $22.1

|

492.3

|

471.6

|

|||||

|

Inventories

|

|

|

|||||

|

Finished

goods

|

410.4

|

384.3

|

|||||

|

Work-in-process

|

308.4

|

298.5

|

|||||

|

Raw

materials

|

143.1

|

134.1

|

|||||

|

Net

inventories

|

861.9

|

816.9

|

|||||

|

Deferred

income taxes

|

249.9

|

274.8

|

|||||

|

Prepaid

expenses and other

|

85.4

|

70.3

|

|||||

|

Current

assets held for sale

|

105.5

|

113.7

|

|||||

|

Current

assets

|

2,078.4

|

2,235.0

|

|||||

|

Property

|

|||||||

|

Land

|

91.7

|

76.7

|

|||||

|

Buildings

and improvements

|

631.6

|

603.2

|

|||||

|

Equipment

|

1,181.7

|

1,111.2

|

|||||

|

Total

land, buildings and improvements and equipment

|

1,905.0

|

1,791.1

|

|||||

|

Accumulated

depreciation

|

(1,046.3

|

)

|

(987.6

|

)

|

|||

|

Net

land, buildings and improvements and equipment

|

858.7

|

803.5

|

|||||

|

Unamortized

product tooling costs

|

156.2

|

149.8

|

|||||

|

Net

property

|

1,014.9

|

953.3

|

|||||

|

Other

assets

|

|||||||

|

Goodwill

|

663.6

|

617.3

|

|||||

|

Other

intangibles

|

322.6

|

331.9

|

|||||

|

Investments

|

142.9

|

141.4

|

|||||

|

Other

long-term assets

|

195.1

|

249.6

|

|||||

|

Long-term

assets held for sale

|

32.8

|

93.0

|

|||||

|

Other

assets

|

1,357.0

|

1,433.2

|

|||||

|

Total

assets

|

$

|

4,450.3

|

$

|

4,621.5

|

|||

|

The

Notes to Consolidated Financial Statements are an integral part of

these

consolidated statements.

|

|

BRUNSWICK

CORPORATION

|

|

Consolidated

Balance Sheets

|

|

As

of December 31

|

|||||||

|

2006

|

2005

|

||||||

|

(in

millions, except share data)

|

|||||||

|

Liabilities

and shareholders’ equity

|

|||||||

|

Current

liabilities

|

|||||||

|

Short-term

debt, including current maturities of long-term debt

|

$

|

0.7

|

$

|

1.1

|

|||

|

Accounts

payable

|

448.6

|

431.7

|

|||||

|

Accrued

expenses

|

748.9

|

803.8

|

|||||

|

Current

liabilities held for sale

|

95.0

|

68.6

|

|||||

|

Current

liabilities

|

1,293.2

|

1,305.2

|

|||||

|

Long-term

liabilities

|

|||||||

|

Debt

|

725.7

|

723.7

|

|||||

|

Deferred

income taxes

|

86.3

|

147.5

|

|||||

|

Postretirement

and postemployment benefits

|

224.2

|

215.6

|

|||||

|

Other

|

240.4

|

245.0

|

|||||

|

Long-term

liabilities held for sale

|

8.7

|

5.7

|

|||||

|

Long-term

liabilities

|

1,285.3

|

1,337.5

|

|||||

|

Shareholders’

equity

|

|||||||

|

Common

stock; authorized: 200,000,000 shares,

$0.75

par value; issued: 102,538,000 shares

|

76.9

|

76.9

|

|||||

|

Additional

paid-in capital

|

378.7

|

368.3

|

|||||

|

Retained

earnings

|

1,820.7

|

1,741.8

|

|||||

|

Treasury

stock, at cost: 11,671,000 and 6,881,000 shares

|

(315.5

|

)

|

(136.0

|

)

|

|||

|

Unearned

compensation and other

|

-

|

(6.1

|

)

|

||||

|

Accumulated

other comprehensive income (loss), net of tax:

|

|||||||

|

Foreign

currency translation

|

38.8

|

14.1

|

|||||

|

Defined

benefit plans:

|

|||||||

|

Prior

service costs

|

(11.2

|

)

|

-

|

||||

|

Net

actuarial losses

|

(121.7

|

)

|

-

|

||||

|

Minimum

pension liability

|

-

|

(88.0

|

)

|

||||

|

Unrealized

investment losses

|

(0.2

|

)

|

(0.1

|

)

|

|||

|

Unrealized

gains on derivatives

|

5.3

|

7.9

|

|||||

|

Total

accumulated other comprehensive loss

|

(89.0

|

)

|

(66.1

|

)

|

|||

|

Shareholders’

equity

|

1,871.8

|

1,978.8

|

|||||

|

Total

liabilities and shareholders’ equity

|

$

|

4,450.3

|

$

|

4,621.5

|

|||

|

The

Notes to Consolidated Financial Statements are an integral part

of these

consolidated statements.

|

|

BRUNSWICK

CORPORATION

|

|

Consolidated

Statements of Cash Flows

|

|

For

the Years Ended December 31

|

||||||||||

|

2006

|

2005

|

2004

|

||||||||

|

(in

millions)

|

||||||||||

|

Cash

flows from operating activities

|

||||||||||

|

Net

earnings from continuing operations

|

$

|

263.2

|

$

|

371.1

|

$

|

263.8

|

||||

|

Depreciation

and amortization

|

167.3

|

156.3

|

153.6

|

|||||||

|

Changes

in noncash current assets and current liabilities

|

|

|

|

|||||||

|

Change

in accounts and notes receivable

|

(4.3

|

)

|

(9.5

|

)

|

(72.0

|

)

|

||||

|

Change

in inventory

|

(28.7

|

)

|

(22.8

|

)

|

(103.9

|

)

|

||||

|

Change

in prepaid expenses and other

|

0.8

|

0.9

|

7.7

|

|||||||

|

Change

in accounts payable

|

9.5

|

29.7

|

40.3

|

|||||||

|

Change

in accrued expenses

|

(70.1

|

)

|

(51.9

|

)

|

74.5

|

|||||

|

Income

taxes

|

(25.5

|

)

|

(3.1

|

)

|

50.1

|

|||||

|

Other,

net

|

38.8

|

(49.1

|

)

|

10.3

|

||||||

|

Net

cash provided by operating activities

of

continuing operations

|

351.0

|

421.6

|

424.4

|

|||||||

|

Net

cash (used for) provided by operating

activities

of discontinued operations

|

(35.7

|

)

|

11.3

|

(9.2

|

)

|

|||||

|

Net

cash provided by operating activities

|

315.3

|

432.9

|

415.2

|

|||||||

|

Cash

flows from investing activities

|

||||||||||

|

Capital

expenditures

|

(205.1

|

)

|

(223.8

|

)

|

(163.8

|

)

|

||||

|

Acquisitions

of businesses, net of cash acquired

|

(86.2

|

)

|

(130.3

|

)

|

(248.2

|

)

|

||||

|

Investments

|

6.1

|

(18.1

|

)

|

(16.2

|

)

|

|||||

|

Proceeds

from investment sale

|

-

|

57.9

|

-

|

|||||||

|

Proceeds

from the sale of property, plant and equipment

|

7.2

|

13.4

|

13.4

|

|||||||

|

Other,

net

|

(0.4

|

)

|

(1.2

|

)

|

2.0

|

|||||

|

Net

cash used for investing activities

of

continuing operations

|

(278.4

|

)

|

(302.1

|

)

|

(412.8

|

)

|

||||

|

Net

cash used for investing activities

of

discontinued operations

|

(5.5

|

)

|

(20.7

|

)

|

(27.1

|

)

|

||||

|

Net

cash used for investing activities

|

(283.9

|

)

|

(322.8

|

)

|

(439.9

|

)

|

||||

|

|

||||||||||

|

Cash

flows from financing activities

|

||||||||||

|

Net

repayments of short-term debt

|

(0.2

|

)

|

(0.6

|

)

|

(8.8

|

)

|

||||

|

Net

proceeds from issuance of long-term debt

|

250.3

|

1.3

|

152.3

|

|||||||

|

Payments

of long-term debt including current maturities

|

(251.1

|

)

|

(6.7

|

)

|

(6.3

|

)

|

||||

|

Cash

dividends paid

|

(55.0

|

)

|

(57.3

|

)

|

(58.1

|

)

|

||||

|

Stock

repurchases

|

(195.6

|

)

|

(76.0

|

)

|

-

|

|||||

|

Stock

options exercised

|

15.9

|

17.1

|

99.5

|

|||||||

|

Net

cash (used for) provided by financing activities

of

continuing operations

|

(235.7

|

)

|

(122.2

|

)

|

178.6

|

|||||

|

Net

cash (used for) provided by financing activities

of

discontinued operations

|

-

|

-

|

-

|

|||||||

|

Net

cash (used for) provided by financing activities

|

(235.7

|

)

|

(122.2

|

)

|

178.6

|

|||||

|

Net

(decrease) increase in cash and cash equivalents

|

(204.3

|

)

|

(12.1

|

)

|

153.9

|

|||||

|

Cash

and cash equivalents at January 1

|

487.7

|

499.8

|

345.9

|

|||||||

|

Cash

and cash equivalents at December 31

|

$

|

283.4

|

$

|

487.7

|

$

|

499.8

|

||||

|

Supplemental

cash flow disclosures:

|

||||||||||

|

Interest

paid

|

$

|

61.2

|

$

|

54.6

|

$

|

46.0

|

||||

|

Income

taxes paid, net

|

$

|

72.0

|

$

|

113.4

|

$

|

58.5

|

||||

|

The

Notes to Consolidated Financial Statements are an integral part of

these

consolidated statements.

|

|

BRUNSWICK

CORPORATION

|

|

Consolidated

Statements of Shareholders’

Equity

|

|

Common

Stock

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Treasury

Stock

|

Unearned

Compensation

and

Other

|

Accumulated

Other

Comprehensive

Income

(Loss)

|

Total

|

||||||||||||||||

|

(in

millions, except per share data)

|

||||||||||||||||||||||

|

Balance,

December 31, 2003

|

$

|

76.9

|

$

|

310.0

|

$

|

1,202.0

|

$

|

(183.6

|

)

|

$

|

(10.1

|

)

|

$

|

(72.2

|

)

|

$

|

1,323.0

|

|||||

|

Comprehensive

income (loss)

Net

earnings

|

—

|

—

|

269.8

|

—

|

—

|

—

|

269.8

|

|||||||||||||||

|

Foreign

currency translation

adjustments,

net of tax

|

—

|

—

|

—

|

—

|

—

|

22.7

|

22.7

|

|||||||||||||||

|

Unrealized

investment gains, net of tax

|

—

|

—

|

—

|

—

|

—

|

11.8

|

11.8

|

|||||||||||||||

|

Unrealized

losses on derivatives, net of tax

|

—

|

—

|

—

|

—

|

—

|

(9.6

|

)

|

(9.6

|

)

|

|||||||||||||

|

Minimum

pension liability

adjustment,

net of tax

|

—

|

—

|

—

|

—

|

—

|

(7.0

|

)

|

(7.0

|

)

|

|||||||||||||

|

Total

comprehensive income —

2004

|

—

|

—

|

269.8

|

—

|

—

|

17.9

|

287.7

|

|||||||||||||||

|

Dividends

($0.60 per common share)

|

—

|

—

|

(58.1

|

)

|

—

|

—

|

—

|

(58.1

|

)

|

|||||||||||||

|

Common

stock issued for Navman acquisition

|

—

|

7.2

|

—

|

9.4

|

—

|

—

|

16.6

|

|||||||||||||||

|

Tax

benefit relating to stock options

|

—

|

28.4

|

—

|

—

|

—

|

—

|

28.4

|

|||||||||||||||

|

Compensation

plans and other

|

—

|

13.2

|

—

|

97.7

|

3.8

|

—

|

114.7

|

|||||||||||||||

|

Balance,

December 31, 2004

|

$

|

76.9

|

$

|

358.8

|

$

|

1,413.7

|

$

|

(76.5

|

)

|

$

|

(6.3

|

)

|

$

|

(54.3

|

)

|

$

|

1,712.3

|

|||||

|

Comprehensive

income (loss)

Net

earnings

|

—

|

—

|

385.4

|

—

|

—

|

—

|

385.4

|

|||||||||||||||

|

Foreign

currency translation

adjustments,

net of tax

|

—

|

—

|

—

|

—

|

—

|

(18.1

|

)

|

(18.1

|

)

|

|||||||||||||

|

Realized

gain from investment sale, net of tax

|

—

|

—

|

—

|

—

|

—

|

(24.2

|

)

|

(24.2

|

)

|

|||||||||||||

|

Unrealized

investment gains, net of tax

|

—

|

—

|

—

|

—

|

—

|

0.9

|

0.9

|

|||||||||||||||

|

Unrealized

gains on derivatives, net of tax

|

—

|

—

|

—

|

—

|

—

|

19.9

|

19.9

|

|||||||||||||||

|

Minimum

pension liability

adjustment,

net of tax

|

—

|

—

|

—

|

—

|

—

|

9.7

|

9.7

|

|||||||||||||||

|

Total

comprehensive income (loss) —

2005

|

—

|

—

|

385.4

|

—

|

—

|

(11.8

|

)

|

373.6

|

||||||||||||||

|

Dividends

($0.60 per common share)

|

—

|

—

|

(57.3

|

)

|

—

|

—

|

—

|

(57.3

|

)

|

|||||||||||||

|

Common

stock repurchase program

|

—

|

—

|

—

|

(76.0

|

)

|

—

|

—

|

(76.0

|

)

|

|||||||||||||

|

Tax

benefit relating to stock options

|

—

|

5.6

|

—

|

—

|

—

|

—

|

5.6

|

|||||||||||||||

|

Compensation

plans and other

|

—

|

3.9

|

—

|

16.5

|

0.2

|

—

|

20.6

|

|||||||||||||||

|

Balance,

December 31, 2005

|

$

|

76.9

|

$

|

368.3

|

$

|

1,741.8

|

$

|

(136.0

|

)

|

$

|

(6.1

|

)

|

$

|

(66.1

|

)

|

$

|

1,978.8

|

|||||

|

Comprehensive

income (loss)

Net

earnings

|

—

|

—

|

133.9

|

—

|

—

|

—

|

133.9

|

|||||||||||||||

|

Foreign

currency translation

adjustments,

net of tax

|

—

|

—

|

—

|

—

|

—

|

24.7

|

24.7

|

|||||||||||||||

|

Unrealized

investment losses, net of tax

|

—

|

—

|

—

|

—

|

—

|

(0.1

|

)

|

(0.1

|

)

|

|||||||||||||

|

Unrealized

losses on derivatives, net of tax

|

—

|

—

|

—

|

—

|

—

|

(2.6

|

)

|

(2.6

|

)

|

|||||||||||||

|

Minimum

pension liability

adjustment,

net of tax

|

—

|

—

|

—

|

—

|

—

|

15.8

|

15.8

|

|||||||||||||||

|

Total

comprehensive income —

2006

|

—

|

—

|

133.9

|

—

|

—

|

37.8

|

171.7

|

|||||||||||||||

|

Adjustment

to initially apply FASB

Statement

No. 158, net of tax

|

—

|

—

|

—

|

—

|

—

|

(60.7

|

)

|

(60.7

|

)

|

|||||||||||||

|

Dividends

($0.60 per common share)

|

—

|

—

|

(55.0

|

)

|

—

|

—

|

—

|

(55.0

|

)

|

|||||||||||||

|

Common

stock repurchase program

|

—

|

—

|

—

|

(195.6

|

)

|

—

|

—

|

(195.6

|

)

|

|||||||||||||

|

Tax

benefit relating to stock options

|

—

|

2.9

|

—

|

—

|

—

|

—

|

2.9

|

|||||||||||||||

|

Reclassification

adjustment to initially apply

FASB

Statement No. 123(R)

|

—

|

(6.1

|

)

|

—

|

—

|

6.1

|

—

|

—

|

||||||||||||||

|

Compensation

plans and other

|

—

|

13.6

|

—

|

16.1

|

—

|

—

|

29.7

|

|||||||||||||||

|

Balance,

December 31, 2006

|

$

|

76.9

|

$

|

378.7

|

$

|

1,820.7

|

$

|

(315.5

|

)

|

$

|

—

|

$

|

(89.0

|

)

|

$

|

1,871.8

|

||||||

|

The

Notes to Consolidated Financial Statements are an integral part